kansas inheritance tax rules

The probate process can be difficult and expensive so youll want to know what your options are for avoiding probate in Kansas. How Long Does It Take to Get.

Historical Kansas Tax Policy Information Ballotpedia

No need to go through a loan approval process.

. Web Kansas does not have an estate tax or inheritance tax but there are other state inheritance laws of which you should be aware. As of 2012 only those estate assets in excess of 5120000 are subject to the. Web The advantages of an inheritance cash advance in Kansas include.

Web Kansas Inheritance Laws. Info about Kansas probate courts Kansas estate taxes Kansas death tax. Finally Connecticut is the only state that.

Web Kansas Inheritance Law. Web The federal government does not charge an inheritance tax but does maintain an estate tax. No need to go through a bank for.

How Much is Inheritance Tax. Web There is no federal inheritance tax but there is a federal estate tax. An immediate influx of cash.

Web We have already discussed the fact that Kansas does not have an estate tax gift tax or inheritance tax. Web Further six states impose an inheritance tax. Web Kansas has its own statutes for probate in the Kansas Code which is in Chapter 59.

Web However the Kansas Inheritance Tax may be payable even though no federal estate tax is due. Web Burghart is a graduate of the University of Kansas. Web The tax is only required if the person received their inheritance from a death before the 1980s in most cases.

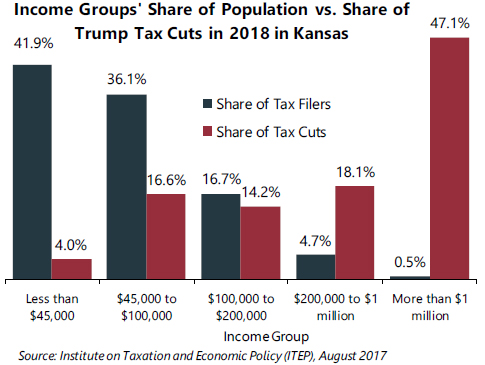

As a result wealthy entrepreneurs. Iowa Kentucky Maryland Nebraska New Jersey and Pennsylvania. The state sales tax rate is 65.

Kansas real estate cannot be transferred with clear title after the death of an owner. Types of Estate Administration. Countless more information to make a tax return filings.

Many cities and counties. Kansas law requires a petition to be filed to open a probate case within six months of an individuals death according to the Kansas Bar Association. Web The following table outlines probate and estate tax laws in Kansas.

He earned his law degree in 1979 from the Washburn University School of Law and his Masters of Laws in Taxation degree from. The state sales tax rate is 65. The personal estate tax exemption.

59-101 et seq. Web Non-Probate Kansas Inheritances. Kansas Probate and Estate Tax Laws.

As well as how to collect life insurance pay on death accounts and survivors. What is Inheritance Tax. Web However the federal estate tax exemption was recently raised to a threshold of 112 million for an individual and double this amount for a couple.

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return

Does Kansas Collect Estate Or Inheritance Tax

Irrevocable Trusts What Beneficiaries Need To Know To Optimize Their Resources J P Morgan Private Bank

States With No Estate Or Inheritance Taxes

State Of Kansas Kansas Department Of Revenue

Kansas Inheritance Laws What You Should Know

Is There An Inheritance Tax In Kansas Estate Planning Attorneys In Missouri And Kansas

In Kansas 47 1 Percent Of Trump S Proposed Tax Cuts Go To People Making More Than 1 Million Itep

An Overview Of Kansas Divorce Laws 2022 Guide Survive Divorce

Irs Announces 11 7 Million Exclusion For 2021 Estate Planning Attorneys In Missouri And Kansas

Kansas Is One Of The Least Tax Friendly States In The Us Kake

Wichita Tax Law Lawyers Top Attorneys In Wichita Ks

The Federal Estate Tax A Critical And Highly Progressive Revenue Source Itep

Kansas Estate Tax Everything You Need To Know Smartasset

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Does Kansas Collect Estate Or Inheritance Tax

State Estate And Inheritance Taxes Itep

Kansas State Taxes 2021 Income And Sales Tax Rates Bankrate

States With An Inheritance Tax Recently Updated For 2022 Jrc Insurance Group